If you a supplier to a retailer using Fieldpine there some steps you can take to help the retailers you are supplying.

Can you supply invoices electronically? (more). If so then sometimes this can help, but not all retailers will accept them yet

Printed Invoices & Other Documents

When you send an invoice to a retailer, they may use electronic techniques to read the invoice. In broad terms this involves taking a scan or picture of the invoice and using software called OCR to read the words. This is not an exact process and the quality of your paperwork greatly affects how reliable this is. If your documents are more reliable the retailer does not need to spend time manually keying your documents.

The following is some examples of invoices that reduce reliability. Bold RED in the illustrations is used to obscure some information. None of the invoices shown below are wrong, they just have some difficulties for the computer to use automatically

Summary

- Do not use shading. Stick to high contrast black and white.

- Chose a clear font and use a reasonable size, especially for numbers.

- Show full detail for maths.

Logos and Shading

Original

Original

1The logo at the top of this invoice contains a stylised Walnut and some wording.

2There are some additional details on lines with background shading.

What the Computer sees

What the Computer sees

1The logo at the top is washed out to black. This is not a serious problem in this example as the company name is shown in normal text below the image. If your company name only appears in logos and graphics, the computer might not be able to easy read your company name

2There are some additional details on lines with background shading. The OCR software really struggles with black text of dark backgrounds. In this example all the details in the shaded lines are invisible to the OCR software. If you use dark shaded lines when listing important information, it is unlikely to be readable. In this example however, the details in the shaded areas are contact details and not needed to read the document.

OCR engines work best with black and white and high contrast. Coloured paper, especially strong colours, typically result in hard to read documents

Accuracy

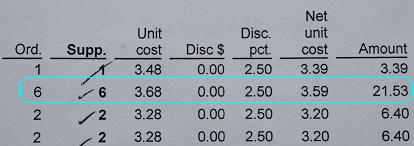

Numbers can be tricky for OCR software, so the we verify all calculations to ensure we've read it correctly. However, if you numbers do not reliably add up then it will be referred to a human operator.

In the highlighted example, the supplier is trying to show a unitcost of 3.68 with a discount of 2.5%

| Base Price | 3.68 | |||

| Less 2.5% discount | 0.092 | |||

| Unit Cost | 3.588 | 3.59 rounded | ||

| Times 6. | ||||

| Total Price | 21.528 | 21.53 rounded. | 21.54 | |

The level of detail in this invoice is fantastic, however, there are some gyrations required due to rounding. While there isn't anything technically wrong with this invoice, please keep in mind that the computer tries check all maths, so clarity is important. The invoice is multiplying 3.588 by 6 to calculate the total price of 21.53, but the 3.588 is not shown on the invoice (the 3.59 rounded figure is shown). If the invoice had shown unit prices to 4 decimal places no exception would be raised. For the small quanties involved in this example the rounding error is minor

When processing, we only permit a 1 cent variation on individual lines and zero cents on addition.

We have also seen examples to incorrect maths, 2 @ $1.10 each equals $3.20. Major problems will always result in document rejection. (is the each cost wrong or the total).

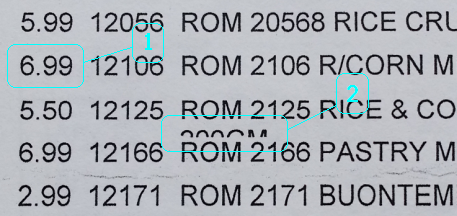

Fonts and Printing artifacts

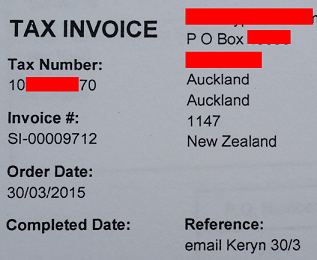

1The font chosen is hard for a computer to read. Specifically "6" and "9" can be easily confused with "8". Notice how the ends of "6" and "9" wrap round to almost close? If the scan is not perfect, fonts like this are sometimes misread as different numbers (which is why all maths is checked)

Remember, if you print your bank account number on the invoice, it will be read too, and if not clear your payment might end up in the wrong account without anybody noticing

2There are some printing artifacts from line wrap. While a human probably doesn't even notice this, to the OCR software it is seen as noise and can lead to misprocessing.

3 This font is very small and used to encode important information. Small fonts result in poor reading accuracy, so this information will probably be missed.

Side note. See the partially obscured words "Tax Invoice" on the right? This information will be lost, potentially resulting in human check being required. The words "Tax Invoice" are legally required (for New Zealand invoices) and the computer checks these are present

Alignment

It is easier for the computer to read left to right naturally. The example shown has lots of detail below headings and two headings side by side. This is a tricky layout for the computer to automatically understand.

If possible, try and layout with classic left/right positioning on the same line.

Tax Number: 10XXXXXX70 Invoice#: SI-00009712 Order Date: 30/03/2015

Electronic Invoicing

Some retailers are able to handle electronic invoicing. There are several options available.

Email. Emailing your invoices can save the retailer the step of scanning your document. The following are the preferred options:

- If possible, use Excel XLSX or Word DOCX, or even simple TXT/CSV documents. These formats are precise and do not have most of the OCR problems outlined above.

- You may send multiple copies of an invoice in different formats, the computer will chose the one it prefers. Example, send an invoice with both a PDF for human use and XML for computer use in the same email.

- PDF format invoices are not ideal and often need to be sent through the OCR process to be understood. Many PDFs are describing a "drawing", even though the drawing is words. (This isn't 100% true all the time, there are several variations and special cases when using PDF documents

- If your invoicing system is able to generate XML documents, email the raw XML. This format is very precise for a computer.

EDI. If your system is capable of direct EDI style communication, ask the retailer about the API end points.

Web Server. Some retailers may offer web portals to allow you to upload and enter your documents directly